Are you ready to explore the dynamic world of financial markets? Online trading offers a unique opportunity to take control of your financial journey, right from your home in India. This guide is your personal roadmap. We will walk you through everything you need to know to get started and build your strategy. Consider this your first step towards achieving online trading success with Binomo India, a platform designed to support your growth as a trader. Let’s begin this journey together and unlock your potential.

- Is Binomo Legal and Regulated for Traders in India?

- How to Register Your Binomo Account in India

- Popular Deposit Methods for Binomo India Users

- Withdrawing Funds from Binomo India: A Step-by-Step Guide

- Navigating the Binomo Trading Platform: Features Overview

- Assets and Indicators Available on Binomo India

- A World of Trading Opportunities

- Powerful Indicators for Technical Analysis

- Understanding Fixed Time Trades (FTT) on Binomo

- A Practical Example

- Effective Trading Strategies for Binomo India

- Utilizing the Binomo Demo Account for Practice

- Who Benefits from the Demo Account?

- Key Advantages of Practice Trading

- How to Make the Most of Your Practice

- The Binomo Mobile App: Trading from Anywhere in India

- Bonuses, Promotions, and Tournaments for Indian Traders

- Common Types of Bonuses for Traders

- Trading Tournaments: Test Your Mettle

- Binomo Customer Support: What to Expect in India

- Real Reviews and User Experiences with Binomo India

- Summary of User Experiences in India

- Risks Associated with Trading on Binomo India and How to Mitigate Them

- Binomo India: Is It the Right Platform for Your Financial Goals?

- Frequently Asked Questions

Is Binomo Legal and Regulated for Traders in India?

This is a critical question for any trader in India looking to use a new platform. When it comes to Binomo, the answer isn’t a simple yes or no. The situation exists in a bit of a legal gray area, and understanding the details is key to trading with confidence.

First, let’s discuss regulation. Binomo is a member of the International Financial Commission (IFC). The IFC is an independent organization that specializes in resolving disputes within the financial markets. This membership provides a layer of security for traders, as it offers a compensation fund and a neutral third party to handle complaints. However, it is crucial to note that Binomo is not regulated by any Indian authority, such as the Securities and Exchange Board of India (SEBI) or the Reserve Bank of India (RBI).

So, what does this mean for its legality? Here’s a breakdown of the key points regarding the legal status for traders in India:

- There are currently no specific laws in India that explicitly prohibit or ban online trading on platforms like Binomo.

- The primary regulations to be aware of are the Foreign Exchange Management Act (FEMA). These rules govern how Indian residents can conduct foreign exchange transactions.

- While FEMA has strict rules about forex trading, using platforms for trading on asset price movements operates differently than physically exchanging currency.

- The responsibility for complying with all tax and remittance regulations falls on the individual trader.

To make it clearer, let’s look at what this regulatory landscape means for you as a trader.

| Factor | Explanation | Implication for Indian Traders |

|---|---|---|

| International Oversight | Membership with the IFC provides a mechanism for dispute resolution and a compensation fund. | You have an external body to turn to for issues, offering a level of protection outside of India. |

| Local Regulation | The platform is not licensed or monitored by Indian financial bodies like SEBI or RBI. | Your trading activities and funds are not covered by Indian investor protection schemes. |

| Legal Framework | Operating in a gray area means it is not officially authorized but also not explicitly illegal. | You must be comfortable with the level of ambiguity and understand the platform’s non-regulated status in India. |

| Fund Transfers | Deposits and withdrawals are subject to FEMA guidelines and your bank’s policies. | It is wise to use e-wallets or payment methods that are known to work smoothly for international transactions. |

In conclusion, while Binomo is not locally regulated in India, many traders in the country use it. The platform operates under international oversight, but the final decision to use it requires you to understand and accept the risks associated with its legal and regulatory status within the country. Always trade responsibly and stay informed about the financial regulations that apply to you.

How to Register Your Binomo Account in India

Ready to jump into the world of trading? Great! Getting your Binomo account set up in India is a breeze. The entire process is designed to be quick and straightforward, so you can move from signing up to placing your first trade in no time. We designed this platform for traders like you, removing unnecessary complications. Let’s walk through the simple steps to get you started on your trading journey.

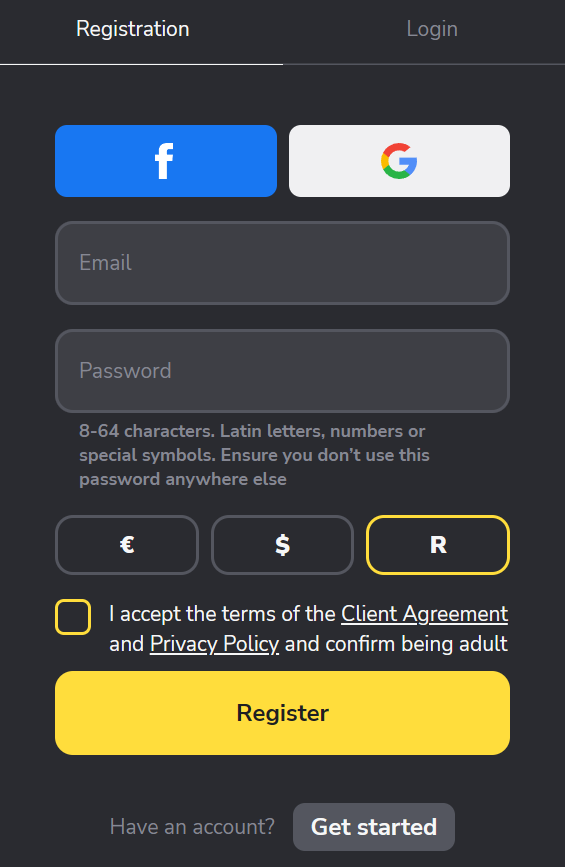

Follow these steps to create your account in just a few minutes:

- Visit the Platform: First things first, head to the official Binomo website or download the user-friendly mobile app. The experience is seamless on any device.

- Find the Sign-Up Button: On the homepage, look for a button that says “Sign Up” or “Register”. It’s easy to spot, usually located at the top of the page.

- Provide Your Basic Details: A registration form will pop up. All you need to do is enter a valid email address and create a strong password for your trading account.

- Choose Your Account Currency: This is an important step! You must select the currency for your account. If you are in India, choosing INR (Indian Rupee) is often the best choice to make deposits and withdrawals simpler. Please note that you cannot change this currency later.

- Accept the Terms: Like any service, there are terms and conditions. Take a moment to review the Client Agreement, then tick the box to confirm you accept them.

- Finalize Your Registration: Click the “Create Account” button to complete the process. That’s it, you’re in!

After you complete these steps, you will receive a confirmation email. Be sure to click the verification link inside to fully activate your Binomo account. Once confirmed, you can start practicing with the demo account immediately or make your first deposit to trade for real.

| Requirement | What You Need |

|---|---|

| Email Address | A valid email you can access for verification. |

| Password | A unique and secure password. |

| Account Currency | Your preferred currency (e.g., INR, USD). This choice is final. |

As you can see, the path to begin trading is clear and simple. We believe in providing traders with direct access to the financial markets without unnecessary hurdles. Your trading account is just a few clicks away.

Popular Deposit Methods for Binomo India Users

When you’re ready to jump into the markets, the last thing you need is a complicated deposit process. Getting your account funded should be fast, secure, and straightforward. For traders in India, having access to familiar and reliable payment options makes all the difference. We understand that convenience is key, so let’s explore the most popular ways to fund your trading journey.

Having a variety of choices means you can pick the method that works best for you at any given moment. Whether you’re at your desk or on the move, funding your account is just a few clicks away. This flexibility helps you avoid transaction failures and ensures you never miss a trading opportunity because of a payment issue. It’s all about making your experience as smooth as possible.

Here’s a quick look at some of the most widely used deposit methods tailored for the Indian market:

| Payment Method | Key Advantage | Best For |

|---|---|---|

| UPI (Unified Payments Interface) | Instant, direct transfers from your bank app. Uses your VPA. | Quickly funding your account from a mobile device. |

| Net Banking | Highly secure and trusted method using your bank’s portal. | Traders who prefer using their primary bank account directly. |

| E-wallets (like PhonePe, Paytm, etc.) | Fast processing times and user-friendly interfaces. | Anyone looking for speed and mobile convenience. |

| Bank Cards (Visa/Mastercard) | Globally recognized and widely accepted. | A reliable and universal payment option. |

UPI and Net Banking stand out as favorites for many traders in India. Their integration with local banks makes them incredibly reliable. You don’t need to sign up for a new service; you simply use the banking systems you already trust. This direct approach adds a layer of comfort and security to your transactions.

Similarly, e-wallets have changed the game for online payments. They offer some of the fastest deposit times, which is crucial when markets are moving quickly. If you want to top up your account and start trading within minutes, an e-wallet is often your best bet. The process is designed to be simple and intuitive, getting you from funding to trading without any unnecessary delays.

Withdrawing Funds from Binomo India: A Step-by-Step Guide

You’ve traded successfully, and now it’s time for the best part: securing your profits. Withdrawing funds from your Binomo India account is a straightforward process. As a trader, I know how important it is to have a smooth and reliable withdrawal experience. Let’s walk through exactly how you can cash out your earnings without any hassle.

Follow these simple steps to move your money from the platform to your personal account.

- Access Your Account: First, log in to your personal Binomo account using your credentials.

- Navigate to the Cashier: Look for the \”Cashier\” or \”Balance\” section. This is usually easy to find on your dashboard. Click on it.

- Select Withdrawal: Inside the Cashier section, you will see options for depositing and withdrawing. Choose the \”Withdraw funds\” option.

- Choose Your Method: Select your preferred withdrawal method. A key rule to remember: you must withdraw funds using the same payment method you used for your deposit. This is a standard security measure.

- Enter the Amount: Specify how much you wish to withdraw from your available balance. Double-check the amount to ensure it is correct.

- Submit Your Request: After filling in the details, review them one last time and submit your withdrawal request. You will usually receive a confirmation that your request is being processed.

Before you make your first withdrawal, there are a few essential things to keep in mind. Paying attention to these points will ensure the process is as quick as possible.

- Account Verification: Ensure your account is fully verified. This process, known as KYC (Know Your Customer), is mandatory and helps protect your account. You will likely need to submit an ID and proof of address. Complete this step early to avoid delays.

- Processing Times: Withdrawal times can vary depending on your chosen payment method and your account status (Standard, Gold, VIP).

- Withdrawal Limits: Be aware of any minimum or maximum withdrawal limits. These are clearly stated in the withdrawal section of the platform.

To give you a better idea of what to expect, here’s a quick look at common withdrawal methods available for traders in India and their typical processing times.

| Withdrawal Method | Average Processing Time |

|---|---|

| IMPS / UPI / Indian Banks | A few minutes to 3 business days |

| E-wallets (e.g., Perfect Money) | Often processed within a few hours |

| Bank Cards (Non-Indian) | 1 to 5 business days |

A smart trader not only knows when to enter a trade but, more importantly, knows how to manage their profits effectively. A smooth withdrawal is the final step of a successful trade.

Navigating the Binomo Trading Platform: Features Overview

When you step into the world of trading, your platform is your command center. It’s where you analyze, decide, and act. A clunky, confusing interface can lead to missed opportunities and costly mistakes. That’s why a clean and intuitive platform is non-negotiable. Let’s take a look under the hood of the Binomo trading platform and see what tools it puts at our fingertips.

The first thing you’ll notice is the focus on clarity. The main screen is dominated by the price chart, just as it should be. Everything else is neatly organized around it, ensuring you can find what you need without a frantic search. Here are some of the core features you’ll work with daily:

- Multiple Chart Types: Whether you’re a fan of Japanese Candlesticks, traditional Bars, or a simple Line chart, you can switch between them instantly. Each type offers a different perspective on price action, letting you tailor your view to your strategy.

- Wide Range of Indicators: No technical trader can work without indicators. The platform comes equipped with the essentials, from Moving Averages and Bollinger Bands to RSI and MACD. You can overlay multiple indicators on your chart to confirm signals and build a robust trading plan.

- Graphical Analysis Tools: Go beyond basic indicators by drawing directly on the chart. Use trend lines to spot momentum, draw channels to identify price ranges, or apply Fibonacci levels to find potential support and resistance zones. These tools give you the power to perform deep technical analysis.

- Flexible Timeframes: You can zoom in and out of the action with a wide selection of timeframes. Analyze short-term movements on the 5-second chart or get a broader market perspective on the daily chart. This flexibility is crucial for traders of all styles, from scalpers to swing traders.

For me, speed and simplicity are everything. When a setup appears, I need to act fast. A platform that lets me execute a trade with just a couple of clicks, without taking my eyes off the chart, is a massive advantage.

To give you a better idea of the layout, here’s a simple breakdown of the main interface components:

| Platform Element | Primary Function |

|---|---|

| Main Chart Area | Displays the real-time price movement of your selected asset. This is your primary workspace for analysis. |

| Asset Selector | A drop-down menu where you can quickly switch between different currency pairs, stocks, or commodities. |

| Trade Execution Panel | Located to the side of the chart, this is where you set your trade amount, duration, and execute your Up/Down trades. |

| Account & History Panel | Provides access to your trading history, account balance, cashier for deposits/withdrawals, and platform settings. |

Ultimately, the Binomo trading platform is designed to be an efficient tool. It strips away unnecessary complexity, providing a streamlined environment where you can focus on what truly matters: analyzing the market and making informed trading decisions.

Assets and Indicators Available on Binomo India

Every successful trader knows their success depends on two things: what they trade and how they analyze it. Your trading platform should be your ultimate toolkit, packed with a wide variety of assets and powerful analytical instruments. This is where you get an edge. On the Binomo platform, we equip traders in India with a robust selection of both, letting you build and execute your strategy with precision.

You gain access to the world’s most popular financial markets from a single account. Forget jumping between different brokers. Here, you can diversify your portfolio and seize opportunities across various sectors. This flexibility is key to managing risk and adapting to changing market conditions.

A World of Trading Opportunities

Explore a diverse range of financial instruments. Whether you follow global economic news or prefer the volatility of digital currencies, you will find an asset that fits your trading style. Our selection includes:

- Currency Pairs: Engage with the dynamic Forex market by trading major, minor, and exotic pairs like EUR/USD or AUD/JPY.

- Stocks: Trade on the price movements of shares from the world’s leading corporations.

- Commodities: Access timeless assets like gold and oil, which often move based on global supply and demand.

- Indices: Trade on the performance of a group of top company stocks from a particular stock market.

Powerful Indicators for Technical Analysis

A price chart tells a story, but technical indicators help you read it. We provide a comprehensive suite of built-in indicators to help you perform deep technical analysis. These tools help you identify trends, measure market momentum, and spot potential entry and exit points. You don’t need to be a market wizard to use them; they are integrated directly into your chart.

| Indicator Type | Popular Examples on the Platform |

|---|---|

| Trend Indicators | Moving Averages, MACD, Parabolic SAR |

| Oscillators | Relative Strength Index (RSI), Stochastic Oscillator |

| Volatility Indicators | Bollinger Bands, Average True Range (ATR) |

Imagine using Bollinger Bands to analyze volatility on a gold chart or applying the RSI to spot overbought conditions in a currency pair. With these tools at your fingertips, you stop guessing and start making decisions based on data. This combination of diverse assets and professional-grade indicators creates a powerful trading environment for everyone.

Understanding Fixed Time Trades (FTT) on Binomo

Let’s cut through the noise and talk about a straightforward way to trade: Fixed Time Trades, often called FTT. If you’re looking for a dynamic trading mechanic without the complexities of leverage and stop-losses, you’ve found it. The core idea on a platform like Binomo is simple. You make a forecast about where an asset’s price will go in a set period. If your forecast is correct when the time is up, you earn a fixed profit. It’s a direct approach to engaging with market movements.

Every single Fixed Time Trade you open is built on four key elements. Mastering these is your first step to trading effectively.

- Asset Selection: This is the instrument you will trade. You can choose from currency pairs, stocks, and other available assets. Pick a market you understand and feel confident analyzing.

- Expiration Time: This defines the trade’s lifespan. You decide how long your forecast needs to hold true, which can range from sixty seconds to several hours. The trade closes automatically when this time expires.

- Trade Amount: This is the capital you decide to invest in a single trade. You have full control over this amount, which also represents your maximum potential loss for that specific trade.

- Your Forecast: This is your market prediction. Will the price of the asset be higher or lower than the opening price when the clock runs out? You simply choose ‘Up’ for a price increase or ‘Down’ for a price decrease.

The process is incredibly streamlined. You select an asset, define your trade amount and expiration time, and then make your forecast. Once you confirm the trade, all you have to do is wait for the outcome. If the price moves in your favor by the time of expiry, the profit is automatically credited to your balance.

A Practical Example

To see how a profit or loss is determined, let’s look at a hypothetical trade. Imagine the platform offers an 85% return on a particular asset.

| Trade Parameter | Your Action | Outcome 1: Correct Forecast | Outcome 2: Incorrect Forecast |

|---|---|---|---|

| Asset | EUR/USD | – | – |

| Trade Amount | $100 | – | – |

| Your Forecast | UP | Price is higher at expiry. | Price is lower or the same at expiry. |

| Result | You receive $185 ($100 stake + $85 profit). | You lose your $100 trade amount. |

The key takeaway is the “fixed” nature of these trades. Before you ever enter a position, you know the exact potential profit and the exact potential loss. There are no surprises. This clarity makes managing your trading capital and risk much more predictable than with some other forms of trading. You always know what’s on the line.

Effective Trading Strategies for Binomo India

Are you ready to dive into the fast-paced world of online trading? Success in the financial markets isn’t just about luck; it’s about skill, discipline, and most importantly, a solid plan. A well-defined strategy can be the difference between guessing and making calculated decisions. For traders using the Binomo India platform, having a clear approach is key to navigating the markets with confidence.

Let’s explore a few popular trading strategies that traders of all levels can use. Remember, no single strategy guarantees a profit, but understanding them is a fundamental step in your trading journey.

- Trend Following Strategy: Often summarized by the saying, \”the trend is your friend,\” this is one of the most straightforward trading strategies. The goal is to identify the primary direction of an asset’s price movement (up, down, or sideways) and open trades in that same direction. Technical analysis tools like moving averages can help you spot the prevailing trend and avoid trading against the market’s momentum.

- Support and Resistance Levels: This strategy involves identifying key price levels on a chart where the price has historically struggled to break through. Support is a price \”floor\” where buying pressure tends to overcome selling pressure, causing the price to bounce up. Resistance is a price \”ceiling\” where sellers take control. Trading based on these levels can provide clear entry and exit points.

- The RSI (Relative Strength Index) Strategy: The RSI is an indicator that helps you determine if an asset is \”overbought\” or \”oversold.\” A reading above 70 typically suggests an asset is overbought and may be due for a price correction downwards. A reading below 30 suggests it is oversold and might be poised for a rebound. This can be a powerful tool for timing your trades.

Choosing a strategy often depends on your trading style and the current market conditions. Here’s a simple comparison to help you understand their best use cases:

| Strategy Type | Ideal Market Condition | Complexity Level |

|---|---|---|

| Trend Following | Strongly trending markets (up or down) | Beginner |

| Support & Resistance | Ranging or predictable markets | Intermediate |

| RSI (Overbought/Oversold) | Reversing or ranging markets | Intermediate |

The most crucial element of any strategy is not the strategy itself, but the risk management that accompanies it. Never risk more than you are willing to lose on a single trade, and always have a plan.

The best way to master these techniques is through practice. Before you begin Forex trading or exploring other assets with real funds, use your demo trading account. This lets you apply these trading strategies in a live market environment without any financial risk. It’s the perfect arena to build your skills, understand how the trading platform works, and find the approach that best suits your goals.

Utilizing the Binomo Demo Account for Practice

Every seasoned trader knows a secret that beginners often overlook: the market rewards preparation, not just courage. Before you dive into the live currents of trading with real capital, you need a safe harbor to learn the ropes. This is where a practice account becomes your single most valuable tool. Think of the Binomo demo account as your personal trading simulator, a risk-free gym where you can build your trading muscles, test your strategies, and get a real feel for the platform’s pulse without spending a single cent.

It’s an exact replica of the live trading environment, giving you access to real-time market data and all the platform’s features. The only difference? You trade with virtual funds. This allows you to experience the thrill of executing trades, analyzing charts, and managing your positions under realistic conditions, all while your actual investment capital remains safely in your pocket.

Who Benefits from the Demo Account?

- The Absolute Beginner: If terms like \”candlestick,\” \”indicator,\” or \”asset\” are new to you, the demo account is your classroom. Learn the basics of placing a trade and navigating the platform interface.

- The Strategy Tester: Have a new trading idea or want to experiment with a different indicator? The demo account is the perfect sandbox to test its effectiveness without financial consequences.

- The Experienced Trader: Even pros use demo accounts to warm up, refine their existing strategies, or get familiar with a new asset they haven’t traded before. It’s a great way to stay sharp.

Key Advantages of Practice Trading

Using the demo account is not just about playing around; it’s about strategic preparation. Here’s a clear breakdown of what you gain:

| Feature | Your Benefit |

|---|---|

| Zero Financial Risk | Build confidence and learn from mistakes without the fear of losing real money. |

| Real Market Simulation | Experience actual market volatility and price movements to understand how assets behave. |

| Full Platform Access | Master all the tools, charts, and indicators available on the platform before you trade for real. |

| Unlimited Practice | Replenish your virtual funds anytime. You can practice for as long as you need to feel ready. |

How to Make the Most of Your Practice

To truly benefit, you must treat your demo trading seriously. Don’t fall into the trap of thinking it’s just a game. Follow these steps to maximize your learning:

- Set Realistic Goals: Trade with a virtual amount that is similar to what you plan to deposit in a real account. This keeps your practice grounded in reality.

- Follow a Trading Plan: Define your strategy, risk management rules, and profit targets before you start. Stick to your plan as if real money were on the line.

- Keep a Trading Journal: Record every trade. Write down why you entered, what happened, and what you could have done better. This analysis is crucial for growth.

- Focus on Consistency: Aim for consistent results and a solid process rather than just making one big \”lucky\” trade. Discipline learned here will be your greatest asset in live trading.

By effectively utilizing the Binomo demo account, you bridge the gap between theory and practice. You transform raw knowledge into honed skill, building the confidence and competence needed to navigate the exciting world of trading. When you are consistently profitable in your demo account and comfortable with your strategy, you’ll know you are ready to take the next step.

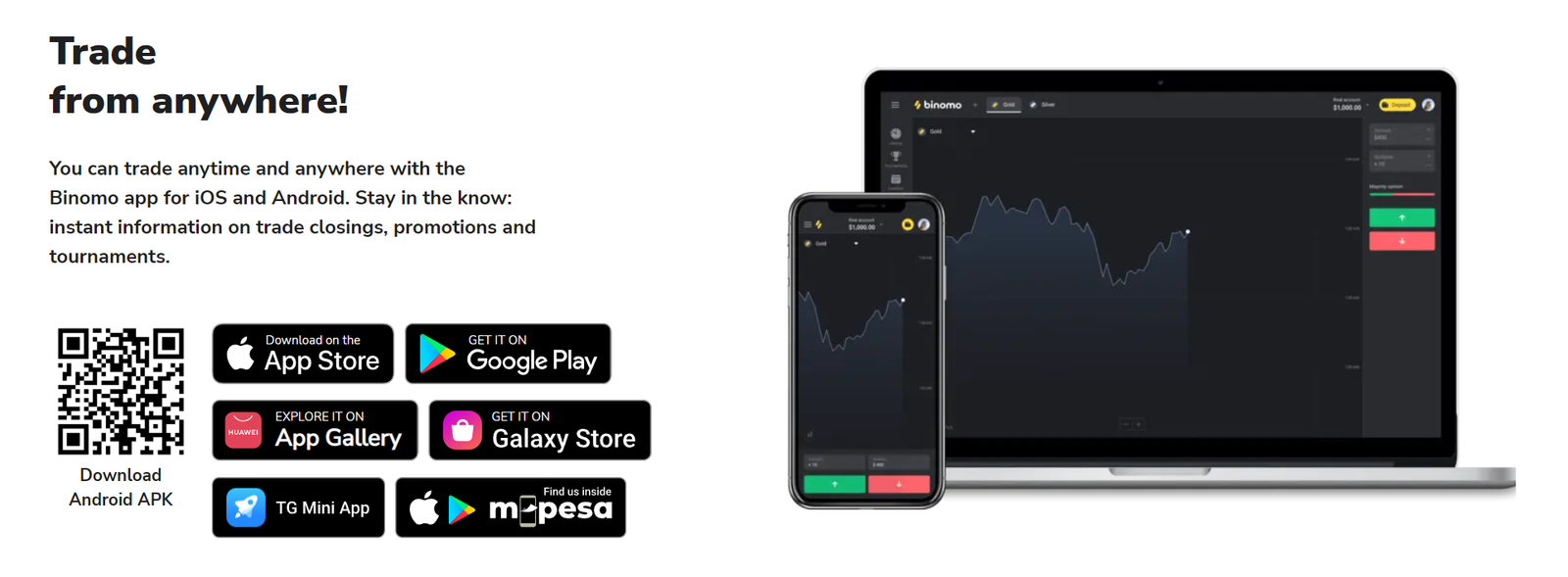

The Binomo Mobile App: Trading from Anywhere in India

Imagine catching a profitable market move while commuting in Mumbai or enjoying a coffee in Bangalore. The world of trading is no longer chained to your desk. With the right tools, you can access global financial markets right from your pocket. This is the ultimate freedom modern trading apps provide.

The Binomo mobile app brings this power directly to your smartphone. It is a compact yet robust platform designed for traders who are always on the move. Whether you are a seasoned pro or just starting, the app delivers a seamless trading experience. You get full access to your account, charts, and trading instruments, all perfectly optimized for your mobile screen.

Let’s break down what makes the mobile app a go-to choice for traders across India:

- Intuitive Interface: The app is incredibly user-friendly. You can find everything you need in just a few taps. No clutter, just pure trading.

- Full Functionality: Don’t think of it as a “lite” version. You can execute trades, analyze charts with indicators, manage your funds, and even contact support directly from the app.

- Instant Notifications: Stay updated with market movements and your trade status. Push notifications ensure you never miss a critical opportunity.

- Practice on the Go: Access your demo account anytime, anywhere. Sharpen your skills and test new strategies without risking real capital while you are out and about.

- Secure Access: Your account security is paramount. The app uses strong encryption to protect your personal data and funds.

How does mobile trading stack up against the traditional desktop experience? Here’s a quick look:

| Feature | Mobile App Trading | Desktop Platform Trading |

|---|---|---|

| Accessibility | Trade from anywhere with an internet connection. | Limited to your desk or laptop location. |

| Convenience | Perfect for quick trades and market checks. | Better for deep, multi-screen analysis. |

| Speed | Fast execution for seizing sudden opportunities. | Robust and stable for complex strategies. |

| Focus | Encourages quick, decisive actions. | Allows for prolonged, in-depth research sessions. |

A fellow trader from Delhi once told me, “The app changed my trading routine. I used to rush home to check the charts. Now, I can manage my positions calmly during my lunch break. It’s a game-changer.” This is the kind of flexibility we all need.

Ultimately, the Binomo mobile app empowers you to integrate trading into your lifestyle, not the other way around. It removes geographical barriers, allowing you to participate in the financial markets on your own terms. For any trader in India looking for flexibility and control, having this powerful tool in your pocket is a massive advantage.

Bonuses, Promotions, and Tournaments for Indian Traders

Let’s talk about something that adds a real spark to our trading journey: the extra perks. As a trader in India, you know every advantage counts. Bonuses, special promotions, and thrilling tournaments can seriously boost your experience. Think of them not just as freebies, but as powerful tools to amplify your trading capital and test your skills in a dynamic environment.

Brokers constantly compete for your attention, and that’s great news for us. It means a steady stream of offers designed to give you more value. Understanding these perks helps you choose the right platform and get the most out of your trading activities. Let’s break down what you can typically find.

Common Types of Bonuses for Traders

- Welcome Bonus: This is the classic handshake deal. You make your first deposit, and the broker adds a certain percentage of it to your account as trading credit. It’s an excellent way to start with more firepower.

- No-Deposit Bonus: A true favourite. You get a small amount of real trading capital just for signing up. It allows you to test the live market conditions and the platform’s execution without risking your own money.

- Reload Bonus: A reward for your loyalty. When you deposit more funds into your existing account, the broker might offer another bonus, keeping your trading momentum going.

- Cashback or Rebates: This is a fantastic ongoing perk. You get a portion of the spread or commission you pay back into your account. Over time, these small amounts add up and effectively reduce your trading costs.

Trading Tournaments: Test Your Mettle

Are you competitive? Trading tournaments are where you can truly shine. These events pit you against other traders in a race to achieve the highest profit percentage over a set period. It’s an incredible way to test your strategies under pressure and learn from the community.

| Advantages of Joining Tournaments | Things to Consider |

|---|---|

| Win substantial cash prizes and other rewards. | Competition can be intense. |

| Gain recognition and bragging rights in the community. | Avoid changing a solid strategy just to chase the leaderboard. |

| A fun way to sharpen your trading skills under pressure. | Always read the tournament rules carefully before entering. |

| Provides clear, short-term trading goals. | The pressure might encourage over-trading or excessive risk. |

Ultimately, these bonuses and promotions are designed to enhance your trading, not replace a solid strategy. Use them wisely to explore new assets, test a different approach with less risk, and add another layer of excitement to your daily market engagement. It’s all about maximizing every opportunity the market offers.

Binomo Customer Support: What to Expect in India

When you’re in the middle of a trade and something unexpected happens, the last thing you want is to feel alone. Reliable customer support is your lifeline. For traders in India, knowing how to quickly contact Binomo is crucial. Let’s break down what you can expect from the Binomo customer support system and how it caters specifically to the Indian market.

Getting in touch with the help desk is straightforward. They offer several channels, ensuring you can find help no matter your preference. Here are the primary ways to reach out:

- Live Chat: This is often the fastest method. You can access it directly from the trading platform or the official website. It’s perfect for getting quick answers to urgent questions.

- Email Support: For more detailed inquiries or issues that require you to send documents, email is a solid option. You can explain your situation thoroughly and attach any necessary files.

- Contact Form: Similar to email, you can fill out a contact form on their website. This ensures your query is routed to the correct department for a faster resolution.

A significant advantage for traders in India is the availability of support in multiple languages, including Hindi. This removes language barriers and makes it much easier to explain complex trading issues and understand the solutions provided. Effective trader support hinges on clear communication, and this is a big step in the right direction.

Response times can vary depending on the channel you use and the volume of inquiries at that moment. Here’s a general guide to what you can typically expect:

| Support Channel | Average Response Time |

|---|---|

| Live Chat | A few minutes |

| Email / Contact Form | Within 24 hours |

As a trader, I value a support team that understands my problems quickly. Having access to fast and knowledgeable assistance gives me the confidence to focus on my trading strategy without worrying about technical glitches.

Beyond direct contact, Binomo also provides a comprehensive Help Center. This section is packed with frequently asked questions (FAQs), tutorials, and articles covering everything from account verification to using different trading tools. It’s a great first stop for finding answers to common questions without needing to contact the support team directly.

Real Reviews and User Experiences with Binomo India

When you’re looking for a new trading platform, it’s easy to get lost in a sea of opinions. What really matters is what other traders on the ground are actually experiencing. Let’s cut through the noise and look at the real user feedback for Binomo in the Indian trading community. We’ve gathered the common chatter, the praises, and the critiques to give you a clear picture.

Many traders, especially those just starting, point to a few key areas they appreciate. Here’s what frequently comes up in positive reviews:

- Simple Interface: Users often mention that the platform is straightforward and not overwhelming. This makes it easy for newcomers to place their first trade without a steep learning curve.

- Low Entry Barrier: The minimal deposit requirement is a huge plus for many Indian traders. It allows you to test the waters with a small amount of capital, reducing initial risk.

- Accessible Mobile App: The ability to trade on the go is a major advantage. Traders praise the functionality of the mobile application for staying connected to the markets.

Of course, no platform is perfect. To give you a balanced view, it’s important to consider the concerns some users raise. These are points to keep in mind:

- Verification Process: Some traders find the account verification process can take time. It’s a standard security measure, but it’s good to be prepared and submit your documents early.

- Limited Advanced Tools: While great for beginners, some highly experienced traders wish for more complex analytical tools and indicators directly on the platform.

Summary of User Experiences in India

| Feature | Common User Feedback |

|---|---|

| Platform Usability | Generally seen as clean, fast, and user-friendly. |

| Deposits & Withdrawals | Multiple local payment methods are available. Withdrawal times can vary based on the method and verification status. |

| Customer Support | Users report mixed experiences, with live chat being the most common point of contact. |

| Educational Resources | The free demo account is widely praised as a valuable tool for practice. |

“I started on their demo account to get the hang of it. Moving to a real account was simple because the interface was the same. The low deposit made me feel comfortable starting out without risking too much. It’s been a solid starting point for my trading journey.”

Ultimately, user experiences show that the platform offers a solid entry point into the world of trading for many in India. It’s crucial to weigh these real-world pros and cons against your own trading style and goals.

Risks Associated with Trading on Binomo India and How to Mitigate Them

Let’s talk real. Every trader knows the rush of a winning position, but the smart ones also respect the risks. Trading on any platform, including Binomo India, comes with its own set of challenges. Ignoring them is the fastest way to empty your account. The key isn’t to avoid risk entirely—that’s impossible. The key is to understand it, manage it, and turn the odds in your favor. Your long-term success depends on how well you handle the inevitable downturns.

Before you place your next trade, take a moment to understand the primary risks you will face:

- Market Volatility: The financial markets can swing wildly due to news, economic data, or unexpected global events. A profitable trade can turn into a loss in seconds.

- Psychological Pressure: Fear and greed are a trader’s worst enemies. Making emotional decisions, like chasing losses or getting overconfident after a win, often leads to poor outcomes.

- Leverage Risk: While leverage can amplify your profits, it equally magnifies your losses. A small market move against your position can result in a substantial financial hit.

- Execution Risk: This is the risk that an order is not filled at the price you expected. Fast-moving markets can cause slippage, especially during high-volatility periods.

Knowledge is your best defense. By actively preparing for these challenges, you can protect your capital and trade with more confidence. Here is a practical breakdown of how to tackle each risk head-on.

| Type of Risk | Effective Mitigation Strategy |

|---|---|

| Market Volatility | Use Stop-Loss orders on every trade. This automatically closes your position at a predetermined price, limiting your potential loss. Avoid trading during major news releases if you are a beginner. |

| Psychological Pressure | Create and stick to a strict trading plan. Define your entry, exit, and risk management rules before you even think about clicking the ‘trade’ button. Never trade when you feel stressed or emotional. |

| Leverage Risk | Use leverage wisely. Never risk more than 1-2% of your total trading capital on a single trade. This ensures that a string of losses won’t wipe out your account. |

| Execution Risk | Trade during periods of high liquidity when possible. Use a demo account on Binomo India to understand how the platform executes orders under different market conditions. |

“The market doesn’t care about your hopes. It only responds to your discipline. A successful trader manages risk first and thinks about profit second.”

Ultimately, trading successfully on Binomo India is a marathon, not a sprint. By embracing risk management, you build a foundation for sustainable growth. Treat your trading capital like a business inventory—protect it fiercely, manage it wisely, and it will give you the opportunity to thrive in the dynamic world of trading.

Binomo India: Is It the Right Platform for Your Financial Goals?

Choosing a trading platform is a critical first step on your financial journey. You need a partner that aligns with your specific goals. Many traders in India wonder if Binomo is the right choice for them. The answer isn’t a simple yes or no. It truly depends on what you, as a trader, are looking to achieve.

To determine if Binomo India is your match, you must evaluate its offerings against your personal trading style and ambitions. Think about what matters most to you. Is it ease of use? Is it a low barrier to entry? Or is it access to specific tools?

Consider these key points when making your decision:

- Your Experience Level: The platform provides a very intuitive and clean interface. This makes it a strong contender for new traders who might feel overwhelmed by more complex dashboards. Experienced traders, however, might find the analytical tools a bit basic for advanced strategies.

- Your Financial Commitment: Binomo allows you to start trading with a small initial deposit. This feature is great for traders who want to test the waters without committing significant capital. It lowers the risk while you build your confidence and skills.

- Your Learning Style: A crucial feature for any trader is the ability to practice without risk. The platform offers a free demo account, which you can replenish anytime. This is an excellent way to test strategies, understand market movements, and get comfortable with the platform’s mechanics before using real funds.

- Your Trading Strategy: The platform focuses on a specific type of trading with fixed-time trades. If this fast-paced style fits your approach and risk tolerance, it could be a perfect fit. If you prefer long-term investing or other trading methods, you may need to look elsewhere.

Here is a straightforward breakdown to help you weigh your options:

| Advantages for Indian Traders | Potential Drawbacks |

|---|---|

| User-friendly and simple interface. | Fewer advanced charting tools. |

| Low minimum deposit and trade amounts. | Asset variety may be limited for specialists. |

| Free and unlimited demo account. | Primarily focused on short-term trading. |

Ultimately, the best platform for your financial goals is one that feels right for you. Binomo India excels in accessibility and ease of use, making it a powerful tool for many entering the world of online trading. We encourage you to define your goals clearly. Then, you can see if this platform has the tools you need to pursue them effectively.

Frequently Asked Questions

Is it safe to trade on Binomo in India?

Binomo operates in a legal gray area in India as it’s not regulated by SEBI or RBI. However, it is a member of the International Financial Commission (IFC), which provides some user protection. Traders should understand the risks of using an internationally regulated platform.

How do I start trading on Binomo?

Getting started is simple. Register on the Binomo website with your email, choose INR as your currency, and verify your account. You can then use the free demo account to practice or make a deposit to start trading with real money.

What are the best ways to deposit money from India?

The most popular and convenient deposit methods for Indian traders are UPI and Net Banking, as they are fast and integrated with local banks. E-wallets like PhonePe and Paytm are also excellent options for quick funding.

How do I withdraw my profits from Binomo?

To withdraw, go to the “Cashier” section, select “Withdraw funds,” and choose your method. You must use the same method for withdrawal as you did for your deposit. Ensure your account is fully verified to avoid delays.

Can I practice trading on Binomo before using real money?

Yes, Binomo offers a free and unlimited demo account with virtual funds. It’s an exact replica of the live trading environment, allowing you to test strategies and get comfortable with the platform without any financial risk.