Ready to dive into the world of online trading but looking for a platform that cuts through the noise? You’ve landed in the right place. Many traders, both new and experienced, seek a straightforward and effective way to engage with the financial markets. This is where Binomo trading comes in, offering a streamlined experience designed to make your journey into trading as smooth as possible.

Forget endlessly cluttered charts and confusing jargon. We believe that trading should be accessible to everyone, and that starts with having the right tools and a clear path forward. This guide is your co-pilot, designed to walk you through every aspect of the platform. We will equip you with the knowledge to trade with confidence.

- What You’ll Discover in This Guide:

- What is Binomo Trading? An Introduction

- Key Features for Every Trader

- Understanding the Platform at a Glance

- How Binomo Trading Works: Understanding the Basics

- Is Binomo Trading Legit? Analyzing Trust and Regulation

- Understanding the Regulatory Landscape

- Why Do Some Traders Cry “Scam”?

- Key Trust Factors at a Glance

- The Bottom Line: Do Your Own Homework

- Binomo Trading Platform: Key Features and Tools

- Core Platform Components

- Analytical Tools at Your Fingertips

- Platform Accessibility and Performance

- Binomo Account Types: Choosing the Right Fit

- The Four Tiers of Trading

- Account Comparison at a Glance

- So, Which Account Is for You?

- Deposits and Withdrawals on Binomo Trading

- Getting Your Account Funded

- Accessing Your Profits: The Withdrawal Process

- A Balanced Look at Financial Operations

- Essential Binomo Trading Strategies for Success

- Riding the Wave: The Trend Following Strategy

- The Reversal Hunter: Trading Support and Resistance

- The Power of a Trading Plan

- Trend Following and Reversal Strategies

- Riding the Wave: The Art of Trend Following

- Catching the Turn: Mastering Reversal Trading

- Head-to-Head: Trend vs. Reversal

- Risk Management Principles

- A Tale of Two Trades

- Binomo Trading App: Mobile Experience and Benefits

- A Full-Fledged Trading Desk in Your Pocket

- Core Benefits of Trading on the Go

- Desktop vs. Mobile: A Quick Comparison

- Utilizing the Binomo Trading Demo Account

- Key Advantages of Starting with a Demo

- How to Make Your Demo Trading Effective

- Binomo Trading: Pros, Cons, and User Reviews

- The Upside: What Attracts Traders to Binomo?

- Common Mistakes to Avoid in Binomo Trading

- Ignoring the Power of the Demo Account

- Trading Without a Safety Net: Poor Risk Management

- Letting Fear and Greed Take the Wheel

- Winging It: Trading Without a Strategy

- The “More is Better” Myth: Overtrading

- Customer Support and Educational Resources for Binomo Users

- Fast and Reliable Customer Support

- A Rich Library of Educational Content

- The Ultimate Training Ground: The Demo Account

- Is Binomo Trading Profitable? Realistic Expectations

- The Trader Makes the Profit, Not the Platform

- A Tale of Two Traders

- Setting Achievable Goals

- Getting Started with Binomo Trading: A Step-by-Step Guide

- Demo vs. Real Account: Key Differences

- Frequently Asked Questions

What You’ll Discover in This Guide:

- Navigating the Interface: We’ll break down the platform’s layout, from finding assets to setting up your charts for optimal analysis.

- Executing Your First Trade: A step-by-step walkthrough on how to open, manage, and close a position.

- Key Strategies for Success: Explore simple yet effective trading strategies that you can apply directly on the platform.

- Understanding Risk Management: Learn the fundamental principles of protecting your capital, a crucial skill for any trader.

- Using the Demo Account: Discover how to leverage the practice account to test your strategies without risking real money.

Whether you’re taking your first step into the financial world or a seasoned trader looking for a more intuitive platform, this guide has something for you. Let’s gear up and transform the way you see the markets. Your path to mastering the Binomo platform starts now.

What is Binomo Trading? An Introduction

Have you ever looked at a financial chart and felt the urge to predict its next move? Binomo trading taps into that exact instinct. At its core, Binomo is a dynamic online trading platform designed for fast-paced market action. It simplifies the trading process, allowing you to speculate on the price movements of various assets over a short period.

Think of it this way: instead of buying an asset and holding it for months, you focus on forecasting its direction. Will the price of a currency pair go up or down in the next minute? You make your prediction, set your trade amount, and wait for the outcome. This approach offers a different way to engage with the financial markets, one that is built on speed and decisiveness.

Key Features for Every Trader

What makes traders consider a platform like Binomo? It often comes down to a few core advantages that cater to both new and seasoned market participants.

- Low Barrier to Entry: You don’t need a massive bankroll to get started. The platform allows for small initial deposits and trade sizes, making it accessible for those who want to test the waters without significant risk.

- Free Demo Account: Before you commit any real capital, you can use a demo account. It comes with replenishable virtual funds, giving you a perfect sandbox to practice your strategies, understand the interface, and build your confidence.

- Wide Range of Assets: You are not limited to just one market. You can trade on currency pairs, stocks, commodities, and other assets, all from a single interface. This allows you to find opportunities across different sectors.

- User-Friendly Interface: The platform is designed to be intuitive. Charts, tools, and trade execution buttons are laid out clearly, reducing the learning curve and letting you focus on what matters most: your trading decisions.

Understanding the Platform at a Glance

To break it down even further, here is a simple overview of what Binomo offers.

| Aspect | Description |

|---|---|

| Platform Type | Online Trading Platform |

| Core Mechanic | Forecasting asset price direction (Up/Down) over a set time. |

| Target Audience | Beginner to intermediate traders looking for a straightforward experience. |

| Key Tool | A full-featured demo account for risk-free practice. |

For many traders, the appeal of Binomo trading isn’t just about the potential profit; it’s about the discipline and analytical skill you develop by making quick, informed decisions in a live market environment.

How Binomo Trading Works: Understanding the Basics

Getting started with trading on the Binomo platform is straightforward. The core of the system revolves around a mechanic known as Fixed Time Trades (FTT). Your main task as a trader is to make a forecast. You predict whether the price of a chosen asset will go UP or DOWN within a specific timeframe. If your forecast is correct when the time expires, you earn a profit. It’s a simple mechanism, but mastering it requires practice and a solid strategy.

Let’s break down the process of opening a trade into a few simple steps:

- Select Your Asset: First, you choose an asset to trade from the available list. This could be a currency pair like EUR/USD, a commodity like gold, or shares of a major company.

- Enter Your Trade Amount: Next, decide how much capital you want to allocate to this specific trade. Always remember to manage your risk and only trade what you are prepared to lose.

- Set the Expiration Time: You then choose the duration for your trade. This can range from a minute to longer periods. This is the point in time when the trade will automatically close.

- Make Your Forecast: This is the crucial step. Based on your analysis of the chart, you predict the price direction. Click the green “UP” button if you believe the price will be higher at the expiration time, or the red “DOWN” button if you think it will be lower.

- Wait for the Result: The platform will track the trade until the expiration time is reached. A correct forecast results in a profit added to your account, while an incorrect one means you lose the trade amount.

To help you navigate the platform, here are a few key terms you will encounter frequently:

| Term | What It Means |

|---|---|

| Asset | The financial instrument you are trading (e.g., currency pair, stock, commodity). |

| Expiration Time | The pre-determined time when your trade will automatically close and the outcome is decided. |

| Profitability | The percentage of your trade amount that you will receive as profit if your forecast is correct. This is shown next to the asset. |

| Chart | The visual representation of an asset’s price movement over time. This is your primary tool for analysis. |

“The essence of trading on this platform isn’t about complex financial models. It’s about making a clear, time-bound forecast on price direction. Your success hinges on the quality of that forecast.”

In short, the trading mechanics are designed for accessibility. You pick an asset, decide on an amount and time, and make a simple up-or-down prediction. This simplicity allows new traders to quickly understand the process, while offering experienced traders a dynamic environment to apply their analytical skills.

Is Binomo Trading Legit? Analyzing Trust and Regulation

Let’s cut straight to the chase. You’ve seen the ads, you’ve heard the name, and now you’re asking the most important question: is Binomo trading a legitimate operation or just another online trap? It’s a smart question every trader should ask before funding an account. The online trading world is full of noise, so separating fact from fiction is key to protecting your capital.

My goal here is to break down the factors that determine a platform’s trustworthiness. We will look at regulation, user experience, and the common red flags you should always watch for. Forget the hype; let’s focus on the facts to help you decide if this platform is a safe place for your trading journey.

Understanding the Regulatory Landscape

When we talk about whether a broker is legit, regulation is the first place we look. A license from a top-tier authority is the gold standard. While Binomo doesn’t hold a license from a major government body, it is a member of the International Financial Commission (FinaCom). What does this mean for you?

- Dispute Resolution: The Financial Commission is an independent, external dispute resolution (EDR) body. If you have a legitimate complaint against the platform that you can’t resolve directly, you can file a case with them.

- Compensation Fund: FinaCom membership includes a compensation fund of up to €20,000 per case. This provides a layer of protection if the commission rules in your favor against the broker.

- Service Quality Audits: The platform undergoes regular audits to verify that it meets the standards of execution quality and business practices set by the commission.

While this is not the same as government-level regulation, it shows a commitment to transparency and provides an avenue for recourse. It’s a significant step above completely unregulated platforms where you have no one to turn to if things go wrong.

Why Do Some Traders Cry “Scam”?

If you search online, you will likely find negative reviews alongside positive ones. This is common for any trading platform. Often, accusations of a scam stem from a few core issues:

- Unrealistic Expectations: Many new traders enter the market expecting to get rich quickly. When they lose money due to high-risk trades or lack of strategy, they sometimes blame the platform. Trading is inherently risky.

- Bonus Terminology: Brokers offer bonuses to attract clients, but these always come with strict terms and conditions, like trading volume requirements. Not reading the fine print before accepting a bonus can lead to withdrawal issues and frustration.

- Verification Problems: To comply with anti-money laundering laws, all legitimate platforms must verify your identity. If the documents you submit are unclear, expired, or don’t match your account details, the process can be delayed. This is a security measure, not a tactic to hold your funds.

Key Trust Factors at a Glance

Let’s summarize the key points in a simple table. Use this as a checklist when evaluating any online trading platform.

| Factor | Analysis for Binomo |

|---|---|

| Regulation & Oversight | Member of the Financial Commission, providing dispute resolution and a compensation fund. |

| Account Verification (KYC) | A mandatory process is in place, which is a standard for legitimate financial services. |

| Demo Account | Offers a free, replenishable demo account to test the platform without financial risk. |

| Platform History | Has been operating for several years, building a track record in the industry. |

The Bottom Line: Do Your Own Homework

So, is Binomo legit? Based on its FinaCom membership and adherence to standard verification protocols, it operates as a regulated entity within its framework. It provides the tools and a platform for trading. However, trust is also personal. I always advise fellow traders to take these steps:

- Start with the Demo: Spend significant time on the demo account. Get a feel for the platform, test your strategies, and see if you like the interface.

- Verify Your Account Early: Complete the account verification process right after you sign up, even before you deposit funds. This avoids potential delays later.

- Start Small: If you decide to trade with real money, start with a small amount you are fully prepared to lose. Never trade with money you can’t afford to part with.

Ultimately, the platform is a tool. Your success or failure depends far more on your trading strategy, risk management, and market knowledge. Trade smart, stay informed, and make your own educated decisions.

Binomo Trading Platform: Key Features and Tools

When you’re navigating the fast-paced world of trading, the platform you use is your command center. It needs to be fast, reliable, and equipped with the right tools. Let’s dive into what makes the Binomo trading platform tick and how its features can support your trading journey.

The first thing you’ll notice is the clean and intuitive interface. It’s designed to minimize distractions, allowing you to focus purely on the chart and your trade execution. This simplicity is a huge plus, especially for traders who are just starting out or those who prefer a straightforward approach without overwhelming clutter.

Core Platform Components

Every trader has different needs, but some features are universally essential. Here’s what forms the backbone of the Binomo experience:

- Free Demo Account: Before you risk any real capital, you can test your strategies with a replenishable demo account. It’s the perfect sandbox to get familiar with the platform’s mechanics and build your confidence.

- Wide Range of Assets: You get access to dozens of trading assets. This includes currency pairs, commodities, and other popular instruments, giving you plenty of opportunities to find trades that fit your analysis.

- Low Entry Barrier: Getting started doesn’t require a huge investment. With a low minimum deposit and the ability to open trades for as little as $1, the platform is accessible to traders of all budget sizes.

- Fast Trade Execution: In a market where every second counts, swift order execution is critical. The platform is built for speed, ensuring your trades are opened at the price you want.

Analytical Tools at Your Fingertips

Successful trading relies on solid analysis. The platform integrates a suite of technical tools directly into the chart, so you can make informed decisions without leaving the interface.

You’ll find a selection of popular technical indicators ready to be applied. These include:

- Moving Averages

- Relative Strength Index (RSI)

- Bollinger Bands

- MACD

In addition to indicators, you can use various graphical tools like lines, channels, and Fibonacci levels to conduct your own technical analysis directly on the live price chart. This combination of tools empowers you to spot trends, identify support and resistance, and find potential entry points.

Platform Accessibility and Performance

Trade from anywhere, anytime. The platform is not just limited to your desktop. It is fully accessible through a web browser or dedicated mobile apps for both iOS and Android devices. This means you can monitor the markets and manage your positions whether you are at your desk or on the move.

| Advantages | Disadvantages |

|---|---|

| User-friendly and intuitive design. | Fewer advanced analytical tools for seasoned professionals. |

| Free and easily accessible demo account. | Focus is primarily on fixed-time trades. |

| Low minimum deposit and trade amounts. | Asset selection might be less extensive than some brokerage platforms. |

| Regular tournaments and contests for traders. | Customization options for the interface are limited. |

“The right tool doesn’t guarantee a win, but the wrong one can certainly guarantee a loss. Choosing a platform that aligns with your trading style is the first step toward consistency.”

Ultimately, the Binomo trading platform offers a streamlined and accessible environment. It’s particularly well-suited for traders who value simplicity, speed, and the ability to get started without a large initial capital outlay. By combining a user-friendly interface with essential analytical tools, it provides a solid foundation for engaging with the financial markets.

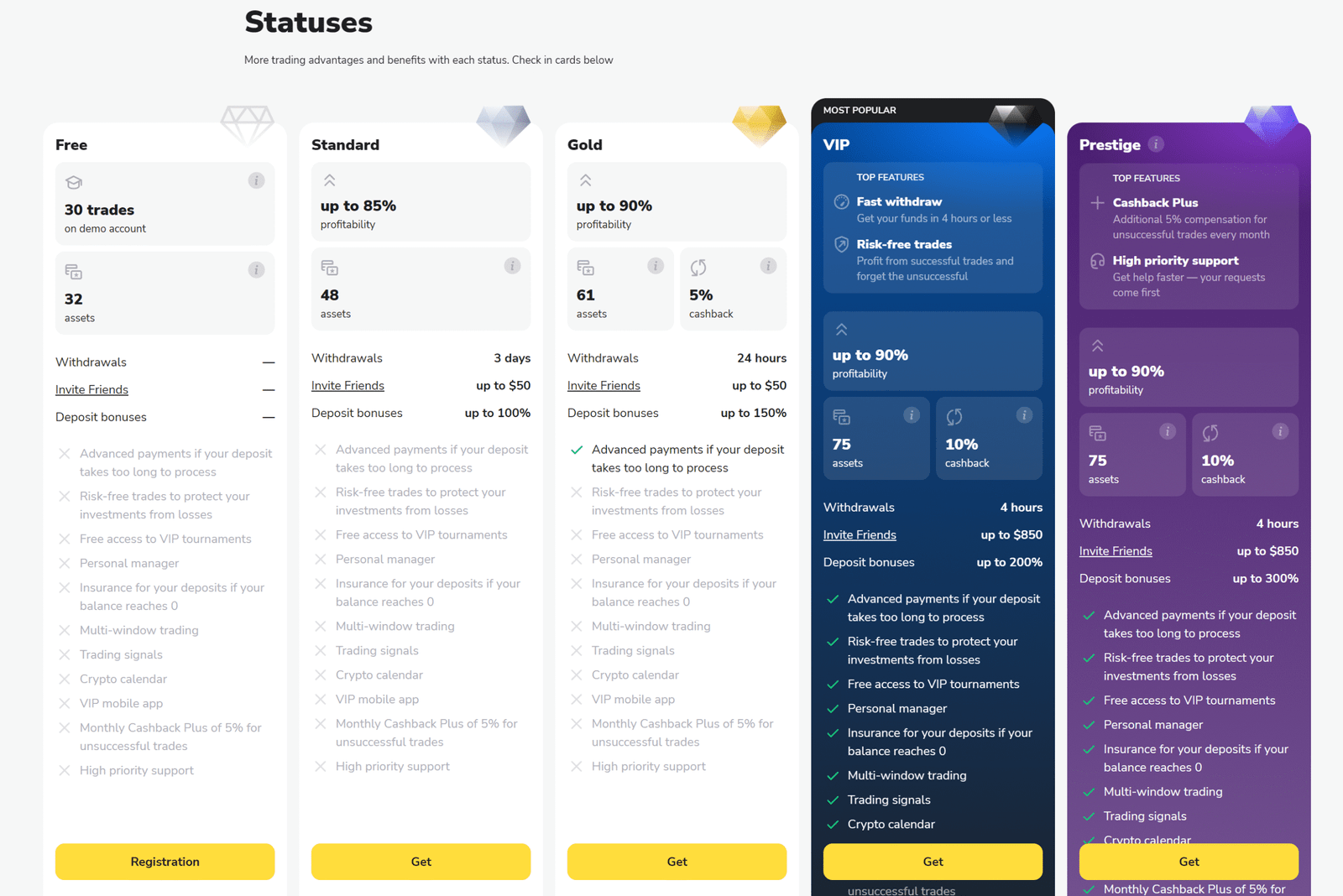

Binomo Account Types: Choosing the Right Fit

Stepping into the trading arena is exciting, but one of the first decisions you’ll make is choosing your account type. Think of it like picking your gear before a big race. The right equipment can seriously impact your performance. Binomo offers a tiered system designed to match your experience, capital, and trading goals. Let’s break down what each level offers so you can find your perfect match and start your trading journey on the right foot.

It’s not just about the money you deposit; it’s about the tools and advantages you unlock. Each tier provides a different level of access and benefits. Making the right choice from the start can streamline your experience and support your growth as a trader.

The Four Tiers of Trading

Your journey on the platform is structured through four distinct account types. Each one is a step up, offering more perks and possibilities.

- Free (Demo) Account: Your personal training ground. This is where you start, completely risk-free. You get virtual funds to practice with, test out strategies, and get a feel for the market’s pulse without spending a dime.

- Standard Account: The starting line for real trading. This is the most accessible entry point for traders ready to use real capital. It unlocks the core features of the platform.

- Gold Account: For the more serious trader. This tier offers enhanced benefits, including access to more assets and faster fund withdrawals, designed to improve your trading efficiency.

- VIP Account: The premium experience. This is the top tier, offering exclusive access to all platform features, a personal manager, and the best trading conditions available.

Account Comparison at a Glance

Sometimes, seeing things side-by-side makes the choice crystal clear. Here is a simple breakdown of what each account brings to the table.

| Feature | Standard | Gold | VIP |

|---|---|---|---|

| Best For | Beginners starting with real funds | Experienced traders seeking better returns | Serious traders demanding exclusive service |

| Available Assets | 40+ | 60+ | 70+ |

| Profitability | Up to 85% | Up to 90% | Up to 90% |

| Withdrawal Time | Up to 3 days | Up to 24 hours | Up to 4 hours |

| Bonuses | Standard bonuses | Increased bonuses | Maximum bonuses |

| Personal Manager | No | Yes (Advisory) | Yes (Dedicated) |

| Insurance & Risk-Free Trades | No | Yes | Yes |

So, Which Account Is for You?

The best account type is the one that aligns with your strategy and comfort level.

A fellow trader once told me, “Don’t pay for tools you don’t know how to use yet.” It’s solid advice. Start where you’re comfortable, prove your strategy, and then level up.

If you are just starting, the Standard account is a fantastic gateway. It lets you trade with real money but with a low initial deposit. As you gain confidence and your trading capital grows, moving up to Gold is a logical next step. The increased profitability and faster access to your funds are significant advantages. For the seasoned trader who trades with significant volume and requires premium support, the VIP account is the ultimate choice. The benefits, like a personal manager and risk-free trades, provide a professional edge that can be invaluable in navigating the markets.

Deposits and Withdrawals on Binomo Trading

Every trader knows the feeling. You spot an opportunity, and you need to act fast. That’s why your trading platform’s financial system must be quick, reliable, and straightforward. A clumsy process for moving your money can be the difference between catching a trend and watching it pass you by. Let’s break down how you can manage your funds and why a smooth system for deposits and withdrawals is crucial for your trading journey.

Funding your account should be the easiest step. You want to get your capital ready for the market without any delays. The platform offers a variety of payment methods to suit traders from different parts of the world. This flexibility ensures you can start trading with minimal hassle.

Getting Your Account Funded

To start, you have several convenient options to make a Binomo deposit. The goal is to get you into the market as quickly as possible. Popular methods include:

- Bank Cards (Visa/Mastercard)

- E-wallets (such as Skrill, Neteller, and others)

- Bank Transfers

- Other Local Payment Solutions

The low Binomo minimum deposit makes the platform accessible, allowing you to start with an amount you are comfortable with. This approach helps you manage risk effectively right from the beginning.

Accessing Your Profits: The Withdrawal Process

Making a profit is exciting, but accessing that profit is what truly matters. A transparent and efficient withdrawal system builds trust. The process to cash out from Binomo is designed to be secure and clear. You always know the status of your request.

“A trader’s confidence is built on two things: their strategy and their broker’s reliability. Knowing you can withdraw your earnings without a headache is non-negotiable.”

Here’s a simple breakdown of the typical withdrawal flow and the average Binomo withdrawal time you can expect.

| Step | Action | What to Expect |

|---|---|---|

| 1. Make a Request | Go to the cashier section and submit your withdrawal request, choosing your preferred method. | The request is instantly logged in the system for processing. |

| 2. Account Verification | Ensure your account is verified. This is a one-time security measure to protect your funds. | Verification protects you from unauthorized access and is a standard industry practice. |

| 3. Processing | The finance department reviews and approves your request. | This typically happens within 24 hours, but often much faster depending on your account status. |

| 4. Funds Received | The money is sent to your bank card or e-wallet. | E-wallet transfers are often instant, while bank transfers might take a few business days. |

A Balanced Look at Financial Operations

No system is perfect, but understanding the benefits and potential limitations helps you plan your trading activities better. Here’s a quick summary of what to consider when managing your funds.

| Advantages | Points to Consider |

|---|---|

| Wide range of payment methods available. | Withdrawal speed can vary based on the chosen method. |

| Low minimum deposit lowers the entry barrier. | Account verification is mandatory before the first withdrawal. |

| No deposit or withdrawal commissions from the platform. | Your payment provider might charge its own fees. |

Ultimately, a solid foundation for funding and withdrawals gives you the peace of mind to focus on what you do best: trading. Knowing that the mechanics of money management are handled efficiently allows you to concentrate on analyzing charts and making informed decisions in the market.

Essential Binomo Trading Strategies for Success

Let’s cut through the noise. Every trader wants the secret formula for guaranteed success. The truth? It doesn’t exist. Success on platforms like Binomo comes from discipline, a solid framework, and a few powerful strategies in your arsenal. Forget hunting for a magic bullet. Instead, focus on mastering proven methods that fit your style.

Your journey begins with understanding how to read the market and react with a clear plan. We will explore some foundational Binomo trading strategies that can help build your confidence and your account balance when applied correctly.

Riding the Wave: The Trend Following Strategy

This is one of the most intuitive approaches to the market. Why fight the current? The core idea is simple: identify the dominant direction of the market and trade with it. If the price is consistently making higher highs and higher lows, you’re in an uptrend. If it’s making lower lows and lower highs, you’re in a downtrend. Your job is to join the party, not try to stop it.

- Identify the Trend: Use visual analysis or simple tools like moving averages to confirm the market’s direction.

- Find Your Entry: Don’t just jump in blindly. Wait for a small pullback or a dip within the trend. This gives you a better entry price.

- Set Your Exit: Decide your profit target and your stop-loss before you ever enter the trade. Ride the trend until you see signs of it weakening.

The Reversal Hunter: Trading Support and Resistance

Markets don’t move in a straight line forever. They often bounce between specific price levels. These levels act like floors (support) and ceilings (resistance). This strategy involves identifying these key zones and trading the price reversals that happen there. It’s a game of patience, waiting for the price to come to you.

When the price hits a strong support level and shows signs of bouncing up, it can be a buying opportunity. Conversely, when it hits a strong resistance level and starts to fall, it can be a selling opportunity. This requires a good eye for chart patterns and price action.

The Power of a Trading Plan

A strategy is useless without a plan. Your trading plan is your business plan. It removes emotion and guesswork, forcing you to trade with logic. It doesn’t need to be complicated. In fact, simpler is often better.

| Component | Example Description |

|---|---|

| Asset to Trade | EUR/USD |

| Strategy Used | Trend Following on the 15-minute chart. |

| Entry Signal | Price pulls back to the 20-period moving average in a clear uptrend. |

| Risk per Trade | Maximum 2% of total account balance. |

| Exit Signal | Take profit at the previous high, or stop-loss if price closes below the moving average. |

The most successful traders are not the ones who are right the most often. They are the ones who have the best control over their losses. Your risk management will define your long-term success more than any single strategy.

Ultimately, the best Binomo trading strategies are the ones you understand deeply and can execute without hesitation. Start with one, practice it on a demo account, and build your trading plan around it. Consistency, not complexity, is the real key to unlocking your potential in the markets.

Trend Following and Reversal Strategies

In the vast ocean of the forex market, traders navigate using two primary maps: trend following and reversal strategies. Think of it this way: are you the type of sailor who rides a powerful current to a known destination, or do you prefer to spot the subtle signs that the tide is about to turn, allowing you to change course before anyone else? Both approaches have immense potential, but they require different skills, mindsets, and tools.

Let’s break down these two powerful methods to see which one aligns with your trading personality.

Riding the Wave: The Art of Trend Following

The classic trading mantra, “the trend is your friend,” is the heart of this strategy. Trend followers don’t try to predict the market’s future. Instead, they identify an established direction—up, down, or sideways—and ride it for as long as it lasts. The goal is to capture the majority of a major market move, entering after the trend has proven itself and exiting once it shows signs of weakening.

Key Characteristics of a Trend Follower:

- Patience is Paramount: You wait for the market to show its hand before making a move.

- Acceptance of Small Losses: Not every breakout becomes a trend. You must be comfortable with small, frequent losses in exchange for occasional large wins.

- Mechanical Approach: This style often relies on indicators like Moving Averages, the ADX, or Parabolic SAR to provide clear entry and exit signals.

- Big Picture View: You focus on higher timeframes to confirm the dominant market direction.

Catching the Turn: Mastering Reversal Trading

Reversal traders are market detectives. They actively hunt for clues that a current trend is running out of steam and is about to change direction. Their goal is to enter a trade at the very beginning of a new trend, maximizing their profit potential by buying at the absolute bottom or selling at the absolute top. This requires a deep understanding of market psychology and price action.

Spotting these turning points often involves looking for specific chart patterns or indicator signals.

Common Reversal Signals:

| Signal Type | What it Suggests | Example |

|---|---|---|

| Chart Patterns | A visual representation of the battle between buyers and sellers ending. | Head and Shoulders, Double Tops/Bottoms, Engulfing Candles. |

| Indicator Divergence | Price is making a new high/low, but an oscillator (like RSI) is not. | Price makes a higher high while the RSI makes a lower high (Bearish Divergence). |

| Volume Spikes | A sudden surge in volume at the end of a long trend can signal exhaustion. | A climatic final push before the market reverses. |

Head-to-Head: Trend vs. Reversal

Neither strategy is inherently superior; they simply offer different risk and reward profiles. Your success depends on aligning your strategy with your personality.

Advantages vs. Disadvantages

Trend Following

Pros: Can capture huge, market-defining moves. Less stressful when you’re on the right side of a strong trend. Clear rules can reduce emotional decisions.

Cons: Performs poorly in ranging or choppy markets. Can have a lower win rate, which requires psychological strength.

Reversal Trading

Pros: Potentially very high reward-to-risk ratios. Can offer a higher win rate if entries are precise. Thrives in ranging markets.

Cons: High risk of “catching a falling knife” if you’re wrong. Requires intense focus and can be psychologically demanding.

Ultimately, the market doesn’t care about your chosen strategy. It only rewards discipline and execution. The most successful traders don’t just pick one style; they understand the principles of both and apply the right tool for the current market condition.

So, ask yourself: Do you prefer the thrill of catching the exact turning point, or the satisfaction of riding a powerful, sustained move? Understanding your own temperament is the first step to mastering the flow of the market.

Risk Management Principles

Every seasoned trader understands a fundamental truth that newcomers often overlook. Your primary mission is not to chase massive profits; it is to fiercely protect your trading capital. Without a disciplined approach to risk management, you are essentially gambling with your funds. Let’s explore the essential principles that distinguish a professional trader and ensure your longevity in the dynamic forex market.

Adopting these rules will transform your approach from hopeful guessing to strategic execution.

- The 1% Rule: This is the cornerstone of capital preservation. Never risk more than 1% of your entire trading account on a single trade. If you have a $5,000 account, your maximum acceptable loss per trade should be no more than $50. This rule ensures that a string of losses won’t cripple your ability to continue trading.

- Set Your Stop-Loss Always: A stop-loss order is your automated safety net. It’s a pre-set order that closes your trade at a specific price point, preventing further losses. Entering a trade without a stop-loss is like navigating a storm without a life raft. It is an absolute necessity for every position you open.

- Calculate Your Risk-to-Reward Ratio: Before you click “buy” or “sell,” you must define your potential profit versus your potential loss. A healthy risk-to-reward ratio, such as 1:2, means you are aiming to make at least twice the amount you are willing to risk. This allows you to remain profitable even if your win rate is less than 50%.

- Use Leverage with Caution: Leverage magnifies your trading power, which means it also magnifies your losses. While tempting, using high leverage is a common pitfall for new traders. Treat it as a sharp tool that requires respect and control, not a shortcut to wealth.

A Tale of Two Trades

Understanding the risk-to-reward ratio in practice makes all the difference. Consider two different trades on the same currency pair.

| Metric | Trade A | Trade B |

|---|---|---|

| Amount Risked | $100 | $100 |

| Potential Reward | $50 | $250 |

| Risk-to-Reward Ratio | 2:1 (Unfavorable) | 1:2.5 (Favorable) |

| Verdict | Poor quality trade. The risk outweighs the potential gain. | Good quality trade. The potential gain justifies the risk taken. |

“The goal of a successful trader is to make the best trades. Money is secondary.” – Alexander Elder

Ultimately, treat your trading as a serious business. Your capital is your inventory, and protecting it is your highest priority. Integrating these risk management principles into your strategy is not about limiting your potential; it’s about building a sustainable and confident trading career. Master your risk, and you position yourself to truly succeed in the markets.

Binomo Trading App: Mobile Experience and Benefits

In today’s fast-moving markets, being tied to a desk is a thing of the past. The modern trader needs flexibility and power in the palm of their hand. This is where a solid mobile trading platform becomes your greatest asset. The Binomo trading app is designed to give you the freedom to trade whenever and wherever opportunity strikes, without sacrificing the tools you need to succeed.

A Full-Fledged Trading Desk in Your Pocket

Forget the idea that mobile trading means a compromised experience. The app delivers a surprisingly robust and intuitive interface. Right from the start, you’ll notice how clean and responsive the layout is. Charts load quickly, and you can easily switch between asset types with a few taps. The developers clearly focused on creating a seamless user experience, allowing you to focus on your strategy, not on figuring out the controls.

You have access to essential analytical tools, including popular indicators. You can draw on charts, adjust timeframes, and execute trades with precision. The entire process, from analysis to execution, feels smooth and efficient, which is critical when every second counts.

Core Benefits of Trading on the Go

Why should you make the switch or add the mobile app to your trading toolkit? The advantages go beyond simple convenience.

- Unmatched Freedom: Trade during your commute, on your lunch break, or while waiting for an appointment. You are no longer chained to your computer.

- Instant Alerts: Set up price notifications and get instant alerts directly on your phone. This means you can react to market movements immediately, even when you’re not actively watching the charts.

- Complete Account Management: The app isn’t just for trading. You can manage your entire account, including making deposits, processing withdrawals, and contacting support, all from one secure place.

- Practice Anywhere: Access your demo account on the app to test new strategies or warm up without risking real capital, no matter where you are.

Desktop vs. Mobile: A Quick Comparison

| Feature | Desktop Platform | Binomo Mobile App |

|---|---|---|

| Accessibility | Requires a computer | Anytime, anywhere with internet |

| Market Alerts | Browser or email notifications | Instant push notifications |

| Core Functionality | Full trading and analysis tools | Full trading and analysis tools |

| Best For | Deep, multi-screen analysis | Reacting to opportunities on the move |

“I used to worry about missing a key market move when I was out. With the app, I get my price alerts and can place a trade in under a minute. It’s completely changed how I manage my positions during the day. It’s not just a backup; it’s a primary tool for me now.”

Ultimately, the Binomo trading app bridges the gap between your daily life and your trading ambitions. It empowers you to stay connected to the markets and act decisively. By integrating this powerful tool into your routine, you ensure that you never miss a potential opportunity again.

Utilizing the Binomo Trading Demo Account

Every successful trader starts somewhere. Before you risk a single dollar of your hard-earned money, you need a safe place to learn the ropes. This is where a demo account becomes your most valuable tool. Think of it as your personal trading gym. It’s a space where you can experiment, make mistakes, and build your skills without any financial consequences. The Binomo trading demo account gives you this exact opportunity, providing a perfect replica of the live trading environment.

So, what makes this practice account so essential? It’s more than just a trial run; it’s a foundational step in your trading journey. You get access to a substantial amount of replenishable virtual funds to trade with. This allows you to experience the platform’s full functionality and understand how trades are executed in real market conditions.

Key Advantages of Starting with a Demo

Jumping straight into live trading can be a costly mistake. Here’s why using the demo account first sets you up for success:

- Risk-Free Learning: The most obvious benefit. You can test different strategies, analyze market movements, and place trades using virtual money. If a trade goes against you, you learn a lesson without losing any real capital.

- Platform Mastery: Every trading platform has its own unique interface. The demo account allows you to get comfortable with the Binomo platform, learn where all the tools are, and understand how to open and close positions quickly and efficiently.

- Strategy Development: Do you have a new trading idea or want to test a specific technical indicator? The demo environment is the perfect sandbox. You can apply your strategies to live market data and see how they perform over time.

- Emotional Control: Trading can be an emotional rollercoaster. Practicing on a demo account helps you understand your psychological triggers. You learn to manage the feelings of excitement and disappointment that come with winning and losing, preparing you for the real deal.

How to Make Your Demo Trading Effective

To truly benefit from the demo account, you must treat it seriously. Here’s a simple comparison to guide your practice:

| Ineffective Practice | Effective Practice |

|---|---|

| Making random, large trades just for fun. | Trading with a virtual amount similar to what you plan to deposit. |

| Ignoring risk management principles. | Applying strict stop-loss and take-profit rules to every trade. |

| Not reviewing your trading history. | Keeping a trading journal to analyze your wins and losses. |

By adopting the mindset of a professional from day one, you build the habits necessary for long-term success. The transition from the Binomo trading demo account to a live account will feel natural and less intimidating. You’ll be equipped not just with knowledge of the platform, but with the confidence that comes from successful practice.

Binomo Trading: Pros, Cons, and User Reviews

Thinking about diving into the Binomo trading platform? Smart move to do your homework first. As traders, we know every platform has its shine and its shadows. Let’s cut through the noise and look at what Binomo really offers, what it lacks, and what fellow traders are saying about their experience. This isn’t about hype; it’s about making an informed decision for your trading journey.

The Upside: What Attracts Traders to Binomo?

Many traders start here

Common Mistakes to Avoid in Binomo Trading

We’ve all been there. Staring at a chart, making a move, and then feeling that sinking feeling of regret. Making mistakes is part of the learning curve in the trading world. But what if you could sidestep the most common traps that trip up 90% of new traders? Learning from the blunders of others is the fastest way to level up your game. Let’s dive into the critical errors many traders make and how you can steer clear of them to improve your Binomo trading performance.

Think of this as your personal cheat sheet to avoid blowing your account. By understanding these pitfalls, you give yourself a real fighting chance.

Ignoring the Power of the Demo Account

One of the biggest fumbles is skipping the demo account. You might feel the rush to jump into real-money trading. But hold on. A demo account is your free-of-charge trading gym. It’s the perfect environment to test your strategies, get a feel for the platform’s execution, and build muscle memory without risking a single cent of your hard-earned capital. Treat it with the same seriousness as a live account. A key principle to remember: if you can’t be profitable on a demo, you have no business trading with real money.

Trading Without a Safety Net: Poor Risk Management

Success is not just about winning trades; it’s about making sure your losses don’t wipe you out. This is where solid risk management comes in. Many new traders risk far too much on a single trade, hoping for that one big win. This approach is a fast track to an empty balance. You need to have strict rules to protect your capital. Here are a few to live by:

- The 1-2% Rule: Never risk more than 1-2% of your total account balance on any single trade. If you have $500 in your account, your maximum risk per trade should be $5-$10.

- Know Your Exit: Before you even enter a trade, you should know at what point you will exit, both for a profit and for a loss.

- Avoid Averaging Down: Never add more money to a losing position. It’s like throwing good money after bad. Accept the loss and look for the next opportunity.

Letting Fear and Greed Take the Wheel

Your biggest enemy in trading is not the market; it’s the person staring back from the screen. Fear and greed are account killers. Emotional trading leads to impulsive decisions that almost always end badly. Fear makes you close winning trades too early, missing out on potential profit. Greed makes you hold onto losing trades for too long, hoping they’ll turn around.

Trading should be a calculated business, not an emotional rollercoaster. See the difference for yourself:

| The Emotional Trader | The Disciplined Trader |

|---|---|

| Trades based on a “gut feeling” or hope. | Follows a pre-defined and tested trading strategy. |

| Chases losses, trying to “win it back” immediately. | Accepts small losses as a business expense and moves on. |

| Gets euphoric after a win and starts overtrading recklessly. | Stays consistent and objective, regardless of the last trade’s outcome. |

Winging It: Trading Without a Strategy

Do you have a plan, or are you just clicking buttons when something “looks good”? Trading without a clear trading strategy is not trading; it’s gambling. A solid plan is your rulebook. It must define:

- Which assets you trade.

- What market conditions you look for.

- Which indicators or price action patterns signal an entry.

- Your rules for exiting the trade.

Having a strategy removes guesswork and keeps you disciplined, especially when the market is volatile. Stick to your plan and trust the process.

The “More is Better” Myth: Overtrading

More trades do not equal more profit. In fact, it often leads to the exact opposite. Overtrading is the compulsion to be in the market at all times, often triggered by boredom, greed, or the desire to recover a recent loss. This leads to taking low-quality setups and deviating from your core strategy. Remember, quality over quantity is the name of the game. Sometimes the most profitable action you can take is to do nothing at all and wait for a high-probability setup.

Customer Support and Educational Resources for Binomo Users

Every trader’s journey, whether you are just starting or have years of experience, involves moments of uncertainty. Questions pop up. A new strategy needs testing. The market throws a curveball. This is where a platform truly shows its value—not just in its trading features, but in the support system it provides. With Binomo, you are never left to figure things out alone. The platform is designed to be your partner, providing help and knowledge every step of the way.

Fast and Reliable Customer Support

When you need an answer, you need it quickly. Delays can mean missed opportunities. Binomo’s support structure is built for speed and efficiency. You can easily access a professional team ready to assist you with any platform-related queries.

- 24/7 Availability: The market doesn’t sleep, and neither does the support team. Get help any time of day, any day of the week.

- Multiple Contact Channels: Reach out through the convenient live chat directly on the platform for instant responses, or send an email for less urgent matters.

- Dedicated Professionals: The support staff are trained to handle a wide range of issues, from account verification to technical questions about the trading terminal.

A Rich Library of Educational Content

Knowledge is your greatest asset in trading. Binomo provides a comprehensive educational ecosystem designed to build your skills and confidence, regardless of your current level.

“You aren’t just given a platform; you’re given a toolbox. The resources here help you learn how to use every tool effectively to build your own success.”

For newcomers, the platform offers a gentle learning curve. You can start with fundamental video tutorials that explain the basics of trading and how to navigate the interface. For those looking to go deeper, a wealth of resources awaits.

| Resource Type | What You Will Gain |

|---|---|

| Strategy Section | Explore a collection of ready-to-use trading strategies. These cover various approaches, helping you find a style that fits your risk tolerance and goals. |

| Video Tutorials | Watch short, easy-to-digest videos on everything from using indicators to understanding chart patterns. Perfect for visual learners. |

| Help Center / FAQ | Find immediate answers to the most common questions traders have about their accounts, deposits, withdrawals, and platform features. |

The Ultimate Training Ground: The Demo Account

Perhaps the most powerful educational tool is the demo account. It is an essential feature for both new and seasoned traders. Here are its key advantages:

- Risk-Free Practice: Trade with a replenishable virtual balance. You can experiment and make mistakes without any financial consequences.

- Strategy Testing: Got a new idea? Test its effectiveness in real market conditions before you risk your own capital.

- Platform Mastery: Familiarize yourself with every button, feature, and tool on the platform until using it becomes second nature.

By combining accessible support with a deep well of educational materials, Binomo empowers you to grow as a trader. It’s a community where you can learn, practice, and refine your skills with confidence.

Is Binomo Trading Profitable? Realistic Expectations

Let’s tackle the big question head-on. Can you actually make a profit trading on Binomo? The short answer is yes, it is possible. However, the profitable outcome isn’t guaranteed by the platform itself. The platform is your trading arena; you are the gladiator. Your success depends entirely on your skill, strategy, and discipline.

Many new traders jump into the financial markets with dreams of instant wealth. This mindset is the fastest way to empty an account. Profitability in trading is a marathon, not a sprint. It’s about making smart, calculated decisions consistently over time. Forget about hitting a single jackpot trade. Instead, focus on building a solid foundation for sustainable growth.

The Trader Makes the Profit, Not the Platform

Think of it this way: giving a world-class chef a basic pan and giving a novice the most expensive cookware money can buy. Who do you think will cook the better meal? The tool helps, but the skill behind it is what truly matters. Binomo trading is no different. A successful trader can find opportunities on various platforms because they possess the core skills needed to succeed.

Here are the pillars of a profitable trader’s approach:

- A Solid Trading Strategy: You need a clear plan. This means knowing which assets you’ll trade, what signals you’ll use to enter or exit a trade, and how to analyze market trends. Trading based on a gut feeling is just gambling.

- Strict Risk Management: This is arguably the most critical skill. Profitable traders know exactly how much they are willing to risk on a single trade and stick to that limit. They protect their capital fiercely because, without it, they can’t trade.

- Emotional Control: Fear and greed are the two biggest enemies of a trader. A profitable trader remains calm under pressure, sticks to their strategy, and doesn’t let a losing streak cause them to make reckless decisions.

- Continuous Education: The markets are always changing. What worked yesterday might not work tomorrow. Successful traders are lifelong learners, always refining their strategies and staying informed about market news.

A Tale of Two Traders

To see how these factors play out, let’s compare the approaches of a profitable trader versus an unprofitable one. This simple table illustrates the stark difference in mindset and action.

| Factor | The Profitable Trader’s Approach | The Unprofitable Trader’s Approach |

|---|---|---|

| Strategy | Follows a tested plan with clear entry and exit points. | Trades impulsively based on emotions or “hot tips.” |

| Risk | Never risks more than a small percentage (e.g., 1-2%) of their account on one trade. | Goes “all in” on trades, hoping for a single massive win. |

| Learning | Uses the demo account to test strategies without financial risk. Analyzes every loss to learn from it. | Jumps straight to a real account. Blames the platform or “bad luck” for losses. |

| Mindset | Understands that losses are part of the game and focuses on long-term net profit. | Gets frustrated by losses and tries to “revenge trade” to win money back quickly. |

Setting Achievable Goals

So, what are realistic expectations? Don’t expect to turn $10 into $1,000 in a week. A more realistic goal is to aim for consistent, small gains. Focus on preserving your capital first and foremost. Use the demo account extensively before you even think about trading with real money. Test your strategy, get comfortable with the platform, and prove to yourself that you can be profitable in a simulated environment first. Once you can consistently grow your demo account over several weeks, you might be ready to start small with a real account.

Profit in trading doesn’t come from being right all the time. It comes from managing your money correctly when you are wrong and maximizing your gains when you are right.

Ultimately, your profitability on any trading platform is a reflection of your preparation and discipline. Treat it like a business, not a lottery ticket, and you will significantly increase your chances of success.

Getting Started with Binomo Trading: A Step-by-Step Guide

Are you ready to jump into the exciting world of online trading? Getting your journey started on the Binomo platform is much simpler than you might imagine. Forget about complicated setups and confusing financial jargon. This guide will walk you through every essential step, from the moment you create your account to placing your very first trade. Let’s get you prepared for the market.

Follow these simple steps to begin your trading experience:

- Sign Up and Create Your Account

Your trading journey begins with a quick and easy registration process. All you need is a valid email address and a secure password. For even faster access, you can use your existing social media account to sign up. Within a minute, you will have full access to the platform. - Explore and Master the Demo Account

Think of the demo account as your personal trading gym. It’s a critical step we recommend for every new trader. Binomo provides you with a generous amount of virtual funds to practice with. Use this amazing feature to:- Get comfortable with the platform’s interface.

- Understand how charts move and react to market news.

- Test different trading strategies without any financial pressure.

- Build your confidence before you start trading with real money.

- Make Your First Deposit

Once you feel confident in your abilities, you can switch to a real account. Making a deposit is a secure and straightforward process. The platform offers a variety of payment methods to fund your account, allowing you to choose the option that is most convenient for you. - Choose an Asset to Trade

Now it’s time to decide what you want to trade. Binomo offers a diverse selection of assets. You can trade anything from major currency pairs and commodities to stocks of leading international companies. We suggest starting with an asset you are familiar with or one you have researched. - Place Your Trade and Make a Forecast

This is where the action happens! First, decide on the amount you wish to trade and set an expiration time for it. Next, make your forecast based on your analysis: do you think the asset’s price will go UP or DOWN from its current level? Click the corresponding button, and your trade is placed. Now, you watch the chart and wait for the outcome.

Demo vs. Real Account: Key Differences

Understanding the distinction between a demo and a real account is crucial for your development as a trader. Here is a simple breakdown:

| Feature | Demo Account | Real Account |

|---|---|---|

| Funds | Virtual, replenishable funds. | Real money that you deposit. |

| Risk Level | Zero risk. You cannot lose real money. | Involves financial risk. |

| Main Purpose | Practice, learning, and strategy testing. | Trading to achieve a profit. |

| Emotional Factor | Low. No emotional stress involved. | High. Real emotions like fear and greed can influence decisions. |

“The best investment you can make is in yourself. Spend time on the demo account; it’s the foundation of your future trading success.”

And that’s all there is to it! You now have the basic roadmap to start trading on the Binomo platform. Remember, consistent practice is the key to improvement. Spend as much time as you need on the demo account until you feel you have a firm grasp of your trading strategy. The market is full of opportunities, and you are now equipped with the tools to begin your journey.

Frequently Asked Questions

What is Binomo Trading?

Binomo is an online trading platform for Fixed Time Trades (FTT), where you forecast an asset’s price direction (Up or Down) within a set timeframe. It’s designed for speed and accessibility with a low entry barrier and a user-friendly interface.

Is Binomo a legitimate platform for trading?

Yes. Binomo is a member of the International Financial Commission (FinaCom), which provides dispute resolution services and a compensation fund of up to €20,000, ensuring a layer of security for traders.

Can I practice on Binomo before using real money?

Absolutely. Binomo offers a free and replenishable demo account with virtual funds. It’s the perfect risk-free environment to learn the platform, test strategies, and build confidence before you trade live.

How do I withdraw my profits from Binomo?

To withdraw, you submit a request through the cashier section. The process requires account verification for security. Withdrawal times vary by account status and method, ranging from up to 4 hours for VIP to 3 days for Standard accounts.

What is the most common mistake to avoid on Binomo?

The most common and costly mistake is poor risk management. Always follow the 1-2% rule (risking only a small fraction of your capital per trade) and never trade without a clear strategy and plan to protect your funds.